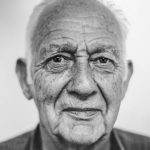

Today’s senior population is composed of men and women who grew up during the 1930s, 40s, and 50s, typically have adult children as well as grandchildren, and have at least a minimal amount saved for retirement. Scam artists are well-aware of the influence of dementia on a growing number of seniors’ decision-making ability, and know exactly how to exploit their trusting nature and willingness to help teenage and young adult family members. In addition, seniors are often new to the internet and more likely to respond to fraudulent requests for online banking information or passwords.

These Common Scams Often Target Seniors:

- Grandparent scams in which a grandchild, supposedly in jail or other trouble, has asked the caller or emailer to contact his or her grandparent with a request for money.

- Debt elimination or debt reduction scams, in which callers or emailers offer no-or low-interest loans for an upfront enrollment fee. Or, similarly, debt consolidation assistance with low monthly payments, however the scammers keep the money and pay little if any toward the existing debt.

- Lottery scams in which a representative from the lottery allegedly seeks an up-front fee to disburse lottery winnings.

- Medical supply scams in which a representative from a company offers free medical supplies or medications for an up-front fee, or with a credit card number.

- Bank or credit card account phishing scams in which the caller or emailer claims to be a company requesting the senior update their account or provide proof they are the account holder.

- Investment scams in which a caller claims to have a lucrative investment opportunity for the senior if they send money or provide banks details.

How Can I Protect My Loved Ones?

Seniors often don’t know what to look for to prevent scams, may be unaware they’ve been scammed, or don’t know how to report such instances. In addition, seniors may feel embarrassed over allowing a scammer to trick them, or afraid adult children will declare them unfit to handle their own finances. You can prevent fraud by:

- Keeping tabs on senior bank accounts and credit reports – either remotely or alongside your loved one – and noting anything unusual.

- Considering additional account oversights, such as a daily withdrawal or point-of-sale

- Un-listing landline phone numbers to preempt scam calls.

- Adding landline and cell phone numbers to national Do-Not-Call lists.

- Discussing common scams targeting seniors in advance.

If your loved one does make you aware of an attempted scam, be reassuring that he or she is always able to seek your help when making financial decisions.

Discuss the scam attempt and point out the elements that don’t make sense, such as the fact that a bank will never ask for account information to be filled in via email.

Finally, assess the need to contact authorities. Doing so can assure your loved one, and help to ensure the same scammers do not target others as well.

Call us at (419) 754-1897 to schedule a free in-home assessment.

You are not alone. We are here to help.

Arista Wins Top Workplaces Award

Arista Wins Top Workplaces Award